Affiliate Fraud Prevention in Fintech

29.08.2025

Contents

Affiliate marketing is a primary driver of customer acquisition in fintech. A bank, a lender, even a young startup can bring in new clients without spending upfront. An affiliate earns a commission only after a lead becomes an account or approved application. But this system works only if affiliates are honest. Implementing affiliate fraud prevention measures early can save significant costs.

Affiliate click fraud happens when partners claim payouts for results that never happened. Instead of sending real users or genuine leads, they use tactics that make performance look better than it really is. And it’s becoming more costly: according to LexisNexis, fraud in digital financial services has risen by 41% in recent years. So, tools for affiliate fraud detection like Bluepear are now essential.

Old tricks, like click farms or fake sign-ups, have been replaced by ad hijacking, cloaked sites, and smart redirects. Each method hides in plain sight, quietly draining marketing budgets. Regular affiliate marketing fraud detection helps companies identify these hidden costs.

Why Fintech Affiliate Channels Are Easy Targets

Data shows how exposed fintech affiliate programs are. High commissions for leads or approved accounts attract both legitimate affiliates and fraudsters. In fintech a single approved credit card or loan application can bring an affiliate $200-$500. In contrast, retail or travel payouts are usually below $50. These high rewards increase the risks of affiliate marketing.

Fraudsters target these incentives directly, using methods that inflate commissions without delivering real customers. Alloy’s 2024 report shows that 25% of financial organizations lost more than $1 million to affiliate click fraud last year. About 35% of companies faced over 1,000 fraud attempts, and 10% experienced more than 10,000 attempts.

Regulations make compliance even more challenging. GDPR, PSD2, and other rules require careful tracking of every lead and conversion. Fraudsters often exploit gaps in these systems, which make suspicious activity harder to detect affiliate fraud.

Because of the combination of high payouts and strict regulatory requirements, fintech affiliate channels are exposed to risks of affiliate marketing. Fraud impacts more than budgets: it distorts reporting, damages brands, and increases regulatory risk. Advanced affiliate fraud detection systems are increasingly deployed to mitigate losses.

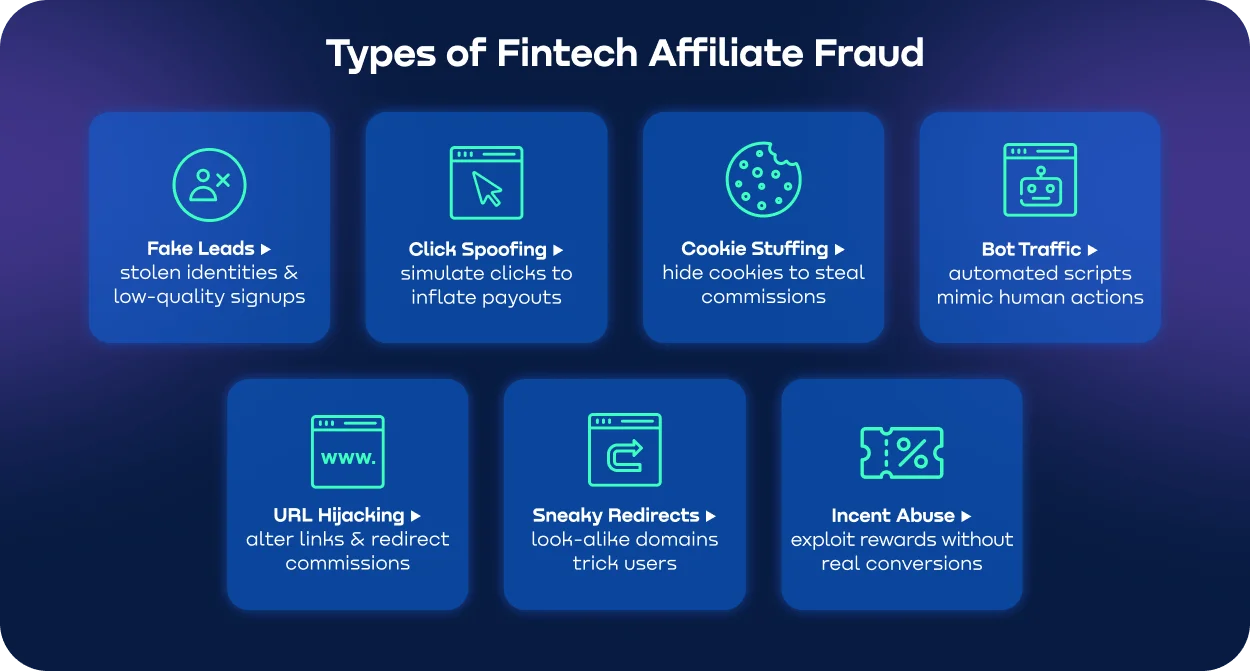

Types of Fintech Affiliate Fraud

Fraud in fintech affiliate programs is difficult to manage because it appears in different forms. Examples range from fake sign-ups to bot-driven clicks that never produce customers. Common tactics include affiliate click fraud, cookie stuffing, sneaky redirects, stolen data, and pretending to be legitimate affiliates. Sub-affiliates can also be a source of trouble, acting without the main partner’s knowledge. This makes affiliate marketing fraud detection critical. This makes prevent affiliate abuse through rigorous affiliate-marketing fraud detection critical.

Brand-related schemes are especially harmful in fintech. Fraudsters might bid on a bank’s name in paid search ads or use your trademark without permission. Often these activities remain undetected until they have already caused damage.

Here’s a closer look at how these scams operate and what they can cost:

| Type of fraud | How it works | Consequences |

|---|---|---|

| Click spoofing | Fake clicks reported as real | You pay for leads that don’t exist (affiliate click fraud) |

| Cookie stuffing | Tracking cookies dropped on users | Attribution is false, CPA goes up |

| Bot clicks | Automated traffic inflates stats | Analytics look good, budget wasted |

| URL hijacking | Fraudulent sites mimic your domain | Traffic is stolen, leads lost |

| Sneaky redirects | Users sent through affiliate links secretly | Conversion data gets messy |

| Identity theft | Fake personal data triggers payouts | Legal and reputational risk |

| Pretending to be affiliate | Fraudsters act like trusted partners | Challenging to detect, trust suffers |

| Sub-affiliate abuse | Unapproved sub-affiliates commit fraud | Losses can emerge suddenly |

| Brand bidding/ad hijacking | Ads run on your brand keywords | Traffic diverted, costs rise |

| Trademark abuse | Your brand used without approval | Potential lawsuits and erosion of customer trust |

Consequences of Fintech Affiliate Fraud

After you understand the tricks fraudsters use, the next question is: what’s the real cost to your business?

In 2024, nearly 2 in 5 UK fintechs reported experiencing fraud losses ranging from £1 million to £5 million. Despite significant direct fraud costs, regulatory fines and penalties are the primary concern for this sector. According to IBM, the average cost of a data breach in financial services reached $5.9 million in 2023, highlighting how expensive affiliate fraud detection can become.

One inflated conversion or a single fake lead can cascade through a fintech business faster than most teams realize, pushing up costs and distorting reports long before anyone notices the numbers aren’t real. Strong affiliate fraud prevention measures can stop these chain reactions.

Affiliate click fraud directly pushes up your cost per acquisition, turning campaigns that should generate profit into a drain on the budget. Misleading data skews your KPIs, leaving teams with unreliable signals for future investment. At the same time shady activity can damage your brand. Customers may lose confidence in the company’s reliability even if the fraud isn’t visible to them.

Regulatory risks add another layer of pressure. Mishandling data or failing to detect affiliate fraud can lead to fines, legal headaches, and costly investigations. Regulators can impose steep penalties for non-compliance with GDPR, PSD2, and KYC/AML mandates, often compounded by remediation costs. Internal teams end up spending hours untangling affiliate click fraud incidents instead of focusing on growth, adding indirect costs that stretch far beyond lost ad spend.

In addition, affiliate click fraud and data breaches can lead to fines and legal consequences. In the UK, there were 3.13 million cases of unauthorized fraud in 2024, an increase of 14% compared to 2023. Without effective affiliate marketing fraud detection operations can seriously disrupt: audits, frozen assets, and lengthy investigations all eat up time and money.

5 Pillars to Stop Fintech Affiliate Fraud

After seeing the damage affiliate click fraud can cause, the logical response is affiliate fraud prevention. Protection works best when it’s layered and consistent.

1. Keep your Terms of Service clear

Write the agreement in plain language. Specify what affiliates can and cannot do, reference GDPR and CAN-SPAM, forbid the use of brand keywords, and define what content is unacceptable. Clear rules establish boundaries and simplify enforcement.

2. Monitor and audit regularly

Fraud often reveals itself through unusual data patterns. Watch for sudden spikes in conversions, repeated IP addresses, traffic at unusual hours, or clicks from unlikely regions. Regular short audits help detect affiliate fraud early.

3. Verify affiliates and sub-affiliates

In fintech partner quality matters. Check email domains, confirm track records, and review who is in the network. Sub-affiliates can add hidden risk, so maintain the right to remove them quickly.

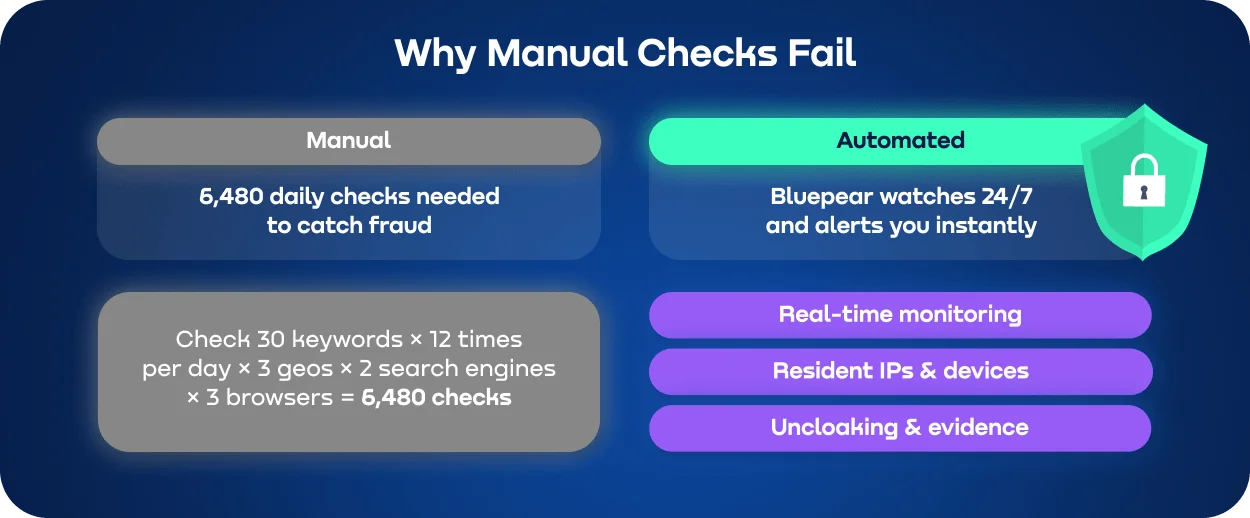

4. Use automated tools wisely

Manual reviews don’t work at scale. AI and behavioral analytics solutions such as Bluepear track clicks, redirects, and attribution in real time. They send alerts when traffic looks suspicious, helping affiliate fraud detection and giving you more control.

5. Work with trusted networks

Choose platforms that screen affiliates before approval. The best ones provide ready-to-use agreements, monitoring, and reporting features, which lowers the likelihood of hidden affiliate click fraud.

Case Study

Even companies with strict affiliate controls have weaknesses. Here's an example of how seemingly insignificant practices can lead to millions in losses.

In January 2022, the U.S. The Federal Trade Commission settled with ITMedia Solutions, a lead-generation company. Users believed they were applying directly for loans, but the data was routed through multiple intermediaries and sold broadly. The FTC imposed a $1.5 million penalty and strict limits on how the company could handle consumer information.

What stands out for fintech marketers is this: 84% of the collected loan applications since January 2016 were never delivered to actual lenders. Instead, they went to marketers and other third parties. This’s a clear example of affiliate marketing fraud detection: high-intent traffic generates apparent conversions, but the value is siphoned off before it reaches the business.

In September 2022, Revolut suffered a data breach affecting over 50,000 customers. Attackers gained access via a social engineering attack on a Revolut employee. Although only 0.16% of the 20 million users were affected, this risk of affiliate marketing highlights that even a single weak point such as human error can expose critical systems.

Even outside the USA, similar patterns can appear: sudden spikes in conversions from a single affiliate, unusual traffic sources, or unexpected sub-affiliate activity.

These cases directly tie back to affiliate fraud prevention strategies. Strict TOS, pre-approved domains, clearly defined data-handling clauses, and continuous automated monitoring for redirects and cloaked pages can stop these situations before they inflict significant damage. Automated tools and trusted networks make enforcement practical, so your program stays secure while growth continues and risk of affiliate marketing reduces.

What these cases shows us:

- • Even strict affiliate controls can fail if traffic isn’t monitored at every step

- • Unclear data routing can cause millions in losses and regulatory penalties

- • Over 80% of collected user data never reached the intended business

- • Unusual affiliate activity (sudden spikes, new sub-affiliates, shady traffic sources) is a red flag for fraud

This is exactly why Bluepear matters: it spots those patterns in real time, connects the dots you can’t see manually and give you visibility needed to stop fraud before it turns into serious damage.

Conclusion

Affiliate marketing remains one of the most effective growth channels for fintech. Anyway, without proper affiliate fraud prevention it can quickly become a source of losses with budgets being spent on fake conversions, metrics being distorted, and regulatory risks of affiliate marketing increasing. Effective affiliate fraud detection ensures the program remains profitable and sustainable.

To minimize these threats, it’s vital to have clear rules for affiliates, conduct regular audits and monitor the networks that the brand works with.

Automated tools of affiliate marketing fraud detection like Bluepear can help track suspicious activity in real-time and respond to violations promptly. As a result, the affiliate program remains not a problem but a sustainable channel for attracting customers.

FAQ

Why are fintech affiliate offers particularly vulnerable?

High commissions, strict regulatory requirements, and large transaction volumes make fintech attractive to fraudsters. Even small lapses in oversight can lead to inflated costs and data inaccuracies. Implementing affiliate fraud prevention reduces exposure.

How can you spot cookie stuffing?

Look for sudden spikes in conversions, repeated IP addresses or devices, unusual traffic patterns, or inconsistencies between clicks and completed actions. Tracking patterns over time helps identify suspicious behavior and detect affiliate fraud.

Which KPIs should you monitor to detect affiliate fraud early?

Key metrics include conversion rates, cost-per-acquisition (CPA), lead quality, geographic sources, and device consistency. Sudden deviations in these indicators often signal potential affiliate click fraud.

Why is brand bidding risky for banks and fintechs?

Unauthorized use of branded keywords can redirect loyal users to fraudulent affiliates, inflate acquisition costs, and expose the company to legal and regulatory risks.

How quickly should you respond to detected violations?

Immediate action is crucial. Automated monitoring tools provide real-time alerts, allowing teams to address issues before they escalate, protecting both budget and reputation, and strengthening affiliate marketing fraud detection.

How Bluepear help protect my affiliate program?

Bluepear combines automated monitoring, fraud detection and real-time alerts in one platform. Instead of manually tracking suspicious activity, teams get clear insights into brand bidding, fake traffic and hidden redirects. This makes fraud prevention faster, more reliable and easier to scale.