Contents

$170B in Fake Clicks: Crushing Mobile Ad Fraud in Affiliate Marketing

Mobile ad fraud fuels app growth but is projected to cost marketers $170 billion a year by 2028 (Statista). It drains your budget while you focus on conversions. Its growth is staggering: from $1 billion in 2010 (Fyber/VentureBeat) to $84 billion in 2023 (Juniper), consuming 22% of ad spend. For perspective: yearly losses from mobile ad fraud are bigger than Disney’s revenue and twice the size of global card fraud.

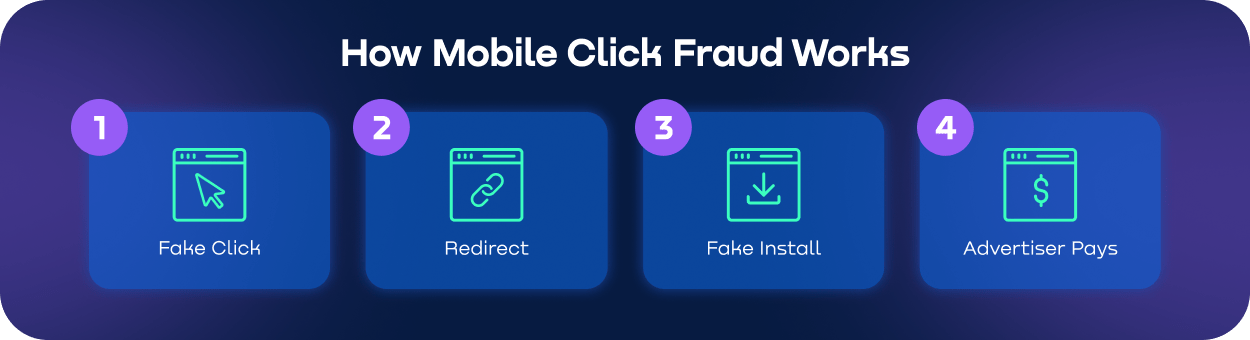

Affiliates are easy targets. While you pay partners for real clicks, fraudsters slip in fake ones and drain your budget. They generate fake traffic, simulate app installs, and corrupt your data. This forces you to optimize campaigns based on false information.

The real question: how much of your affiliate spend is actually feeding this $170 billion mobile ad fraud machine?

If your defense relies on network-reported metrics, you're already compromised. Let's dissect exactly how fraudsters exploit your affiliate channels – and how to break their system.

Why Affiliate Fraud Targets Mobile’s Highest Stakes

Mobile advertising fraud follows the money – and right now, mobile’s explosive growth makes it a prime target. As digital ad spend climbs to record highs, high-LTV verticals like gaming, fintech, and e-commerce face disproportionate risk. Here’s why:

Gaming apps see constant fraud because it costs a lot to get users, and users spend heavily inside the apps. Criminals create fake installs and hijack user sessions to steal affiliate payouts.

Fintech and banking apps attract sophisticated attacks. Why? Because a loyal user here is worth much more than in most other industries. A common trick is "click flooding" – where fraudsters flood the system with clicks just before a real user installs the app, stealing credit for that organic install and draining budgets without being noticed.

E-commerce and travel have their own challenges. Users often switch between phones, tablets, and computers while shopping or planning trips. This complexity helps fraudsters hide fake clicks among real interactions. So, this kind of discovery is a major wake-up call for the industry.

So, what's driving this surge? Three key shifts:

1. Privacy rules (like ATT and GDPR) broke traditional ways to track users, creating blind spots that fraudsters love to exploit.

2. Easy-to-access cloud tools now let criminals run huge networks of bots that can mimic real people incredibly well, and at massive scale.

3. The fraud itself has changed. It's no longer just about fake installs. Now, the biggest problem is post-install fraud – faking valuable actions inside the app, like purchases or sign-ups, which does far more damage.

It simply means that where it's hard to track results and payouts are high, mobile advertising fraud will thrive. If your business is in one of these high-value mobile sectors, you need to know: your affiliate traffic is under serious threat.

How Fraudsters Drain Your Budget: 5 Mobile Click Scams Exposed

Mobile affiliate fraud isn’t abstract – it’s executed through specific, repeatable scams. Understanding types of mobile ad fraud is your first defense. We expose five mobile click fraud:

Click injection occurs when malware on user devices triggers fake clicks during app installation. This falsely credits fraudsters for organic installs. Detection tools analyze click-install timing: real users take seconds/minutes; injections happen in under 1 second.

Click flooding sends thousands of fake clicks to attribution systems for a single user. Fraudsters aim for one click to align with a genuine install, enabling false commission claims. Detection identifies abnormal patterns – such as 50+ clicks per device hourly or identical timestamps across multiple devices.

SDK Spoofing is pure forgery. Criminals reverse-engineer your app’s SDK, fabricating fake installs that mimic legitimate data packets. They’ll simulate devices, locations, even in-app events. Detection tools identify anomalies like mismatched device models between clicks and installs, or physically impossible location changes.

Device ID reset fraud exploits Android’s advertising resets. Fraudsters constantly reset device IDs, making one device appear as hundreds of "new users" to generate fake installs. Prevention requires tracking resets-per-device and flagging abnormal frequencies – say, 50+ resets daily.

Ad stacking & hidden ads are visual scams. Publishers stack multiple ads in one slot (users see only the top ad) or hide ads off-screen. You pay for invisible "impressions." Detection tools analyze viewability metrics and session depth – real users scroll, hidden ads generate clicks without engagement.

Human reviewers can't keep up with the data deluge and speed of mobile advertising fraud. Smart automation fills the gap: analyzing vast data streams in real-time to cross-check device history, network signals, and user behavior. By spotting inconsistencies, it separates real users from fraud. Recognizing types of mobile fraud is essential, but combining that insight with automation is key to protecting your budget.

The Invisible Tax: How Click Fraud Bleeds Affiliate Budgets Dry

Mobile click fraud increases advertiser costs by faking user engagement in affiliate programs. When you pay partners for clicks that should convert, a significant portion funds fraudulent activity instead. This hits three critical areas:

Budget and ROI take the hardest hit. Every fraudulent click costs you $3.32 on average (Gitnux), draining cash that should fuel growth. At scale, mobile click fraud adds up to $44 billion wasted globally – money that could transform real campaigns. What makes this worse? 76% of fraud comes from bots, meaning automated systems siphon your budget while you sleep.

Your analytics become unreliable due to mobile advertising fraud. When 52% of advertisers face it yearly, campaign data stops reflecting reality. Mobile campaigns suffer most here – their clicks carry a 28% higher fraud risk than desktop, so optimizing based on these metrics actively hurts performance. You might shift budgets toward sources that look productive but are actually bots.

Brand trust erodes from specific types of mobile ad fraud. 21% of fake clicks deploy malware through compromised ads. When users encounter virus alerts or phishing scams after clicking your affiliate links, they blame your brand – not the partner. This creates silent churn that’s hard to track but costly to repair.

Against these types of mobile ad fraud, automated prevention delivers 35% higher ROI. Companies reclaim stolen budgets, restore data accuracy, and protect reputations – turning mobile advertising fraud defense into profit.

Detecting Mobile Click Fraud Before It Kills Your ROI

Spotting mobile click fraud demands forensic attention: the real threats hide in anomalies everyone else ignores. Here's what elite performance marketers monitor:

Geotraffic

Start by checking where your traffic comes from. If you see lots of clicks from places that don't make sense for your audience, that's a red flag. For instance, when an investment app noticed high-value users coming from rural areas where people typically don't have enough money for their minimum deposits. Or when most clicks come from regions with poor internet service – that traffic probably isn't real.

Post-install behavior

Watch what happens after people install your app. Real users explore features, but fraud often shows different patterns. For example, if most users uninstall within an hour or only open the app once or twice before disappearing, those are likely bots. One travel company found most of their affiliate-installed "users" deleted the app before even searching for flights – behavior that doesn't match real people.

Compare data

Don’t forget to compare your performance in different systems. If your partner reports conversions that don't show up in your app's real data, that says a lot. Perhaps they claim 1,000 purchases, while your registration records show only 200 active users. Or Google Analytics shows engagement that doesn't match what's happening in your app.

Search Keyword

Finally, keep an eye on search traffic too. Fraudsters sometimes fake branded searches to collect commissions. So, watch for sudden spikes in exact-match brand searches, especially if installs from these searches open suspiciously fast – faster than a real person could click.

Here's the uncomfortable truth: if you're not automating detection, you're funding fraudsters' innovation. For comprehensive mobile ad fraud prevention, automation is non-negotiable.

For legal safeguards against rogue partners, master FTC compliance in our guide to affiliate fraud detection. And if you spot these patterns? Learn how to terminate bad actors in our breakdown of affiliate fraud types.

Why Automation is Your Only Real Defense

Manual fraud detection fails against evolving mobile advertising fraud. Fraudsters now use bots that perfectly copy human behavior – scrolling, tapping, and engaging across thousands of devices at once. They hide behind proxy networks that make cheap traffic appear as premium users from valuable locations, while geo-spoofing tricks basic filters. By the time human reviewers spot these, the damage is already done.

Automated detection works differently. These tools constantly analyze traffic patterns, identifying spoofed locations through residential IP checks and flagging suspicious behavior by how users interact with content. They never sleep, catching threats in real-time 24 hours a day.

But while automated tools solve mobile fraud challenges, they don't cover everything. Many brands face two additional threats in their affiliate programs that need separate attention:

• First, trademark hijacking where competitors bid on your brand terms in paid search results.

• Second, policy violations where partners use expired promotions or non-compliant tracking links. These issues might not involve fake clicks, but they still drain budgets and damage brand trust.

This is where Bluepear steps in to deliver crucial mobile ad fraud prevention. It continuously scans paid search results worldwide to catch competitors abusing your brand terms. For affiliate monitoring, it tracks links using UTM parameters across partner networks. When it finds violations, Bluepear automatically documents everything with timestamped evidence – including full redirect paths and landing page screenshots – making enforcement simple.

Faster resolution of affiliate issues so you can stop budget leaks from non-compliant partners, maintain program health, and protect your brand across search channels. For complete protection, most successful brands combine specialized mobile ad fraud prevention tools with Bluepear's search and affiliate monitoring. This layered approach covers your entire marketing ecosystem.

Secure Your Growth Against Evolving Fraud

Fraud tactics evolve daily, but modern defense tools evolve faster. Today’s solutions detect threats in real-time, transforming vulnerable affiliate channels into trustworthy growth engines. This means reclaimed budgets, optimized partnerships, and decisions grounded in clean data.

For mobile ad fraud specialized tools are essential. But comprehensive protection requires guarding all attack surfaces – including search hijacking and affiliate policy violations.

This is where solutions like Bluepear complement your defenses:

• They monitor paid search 24/7 to stop brand bidding

• Track affiliate compliance through UTM patterns

• Generate evidence for swift enforcement

FAQ: Mobile App Click Fraud

What is mobile app click fraud?

Fraudsters generate fake clicks on mobile ads to steal affiliate payouts or drain advertiser budgets, often using bots or click farms – a pervasive form of mobile ad fraud.

Which industries suffer most from mobile ad fraud?

Fintech, gaming, and e-commerce face highest mobile advertising fraud risk due to high-value actions (installs, purchases) targeted by fraudsters.

What is click injection?

A mobile click fraud where malware on user devices "injects" fake clicks just before app installation, hijacking legitimate install credit.

How can I detect mobile click fraud?

Monitor for: Geotraffic mismatches (luxury app clicks from low-income regions) Abnormal click-to-install speeds (<3 seconds) Discrepancies between network reports and actual logins

How fast do automated tools detect mobile click fraud?

Advanced systems flag types of mobile ad fraud in under 10 seconds – stopping budget drain before campaigns end.

Can automation actually prevent mobile click fraud?

They significantly reduce fraud but can’t eliminate it entirely. Tools like BluePear complement this by solving non-mobile threats:

• Monitoring paid search for brand bidding abuse

• Tracking affiliate compliance via UTM parameters

• Providing timestamped evidence (redirect paths + landing page screenshots)